Consumer sentiment improves in Q3 2021 and for Q4 2021, but is less optimistic for the next 12 months

Consumer sentiment improves in Q3 2021 and for Q4 2021, but is less optimistic for the next 12 months

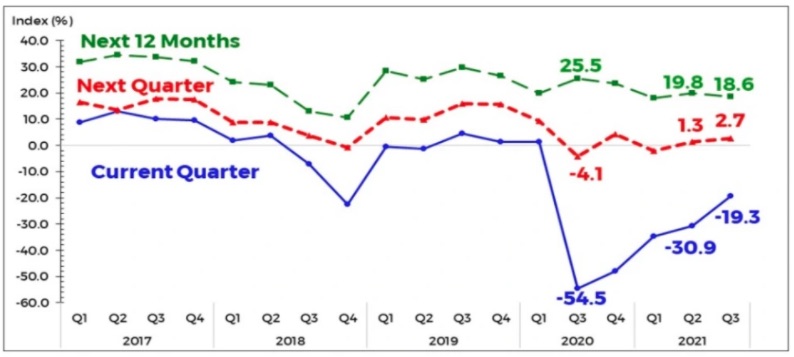

Based on the Q3 2021 survey results, consumer sentiment in the country continued to improve for Q3 2021 as the overall confidence index (CI) was less negative at -19.3 percent from-30.9 percent in Q2 2021. Notably, the consumer outlook has been improving steadily since Q3 2020, the quarter when the index reverted to negative mainly due to the COVID-19 pandemic. The higher Q3 2021 CI, although remaining negative, showed that the number of households with optimistic views increased relative to the number in Q2 2021, but was still less than those with pessimistic views during Q2 2021. According to respondents, their improved outlook during Q3 2021 was brought about by their expectations of: (a) availability of more jobs and more working family members, (b) additional/higher income, and (c) effective government policies and programs, particularly in addressing COVID-19-related concerns, such as the availability and rollout of vaccines, provision of financial assistance, and easing of quarantine restrictions.

Similarly, consumer sentiment for Q4 2021 improved as the CI increased to 2.7 percent from the Q2 2021 survey result of 1.3 percent. However, the respondent’s outlook for the next 12 months was less optimistic as the CI declined to 18.6 percent from the Q2 2021 survey result of 19.8 percent. Respondents attributed their optimism to the following expectations: (a) availability of more jobs, (b) additional and high income, (c) effective government policies and programs, and (d) stable prices of commodities.

Consumer outlook generally improves across the three component indicators and across income groups in Q3 2021 and for Q4 2021 and the next 12 months

The improved consumer sentiment in Q3 2021 and for Q4 2021 was observed across the three component indicators of consumer confidence, namely, the country’s economic condition, family’s financial situation, and family income.

Consistent with the national trend, consumer confidence across income groups also improved in Q3 2021, though remaining negative, from the Q2 2021 survey results. Aside from the aforementioned reasons cited for the less pessimistic outlook in Q3 2021, consumer confidence for the middle- and high-income groups improved as they anticipated availability of permanent employment.

Consumers’ spending is more upbeat for Q4 2021

The households’ spending outlook on goods and services for Q4 2021 was more upbeat as the CI increased to 31.4 percent from 25.4 percent in the Q2 2021 survey result.

Buying sentiment in Q3 2021 and buying intentions over the next 12 months for big-ticket items are more buoyant

The percentage of households in the country that considered Q3 2021 as a favorable time to buy big-ticket items increased to 13.3 percent from 11.7 percent recorded in Q2 2021. Further, the percentage of households in the country that considered the next 12 months as a favorable time to buy big-ticket items rose to 4.1 percent from 3.6 percent in the Q2 2021 survey result.

The percentage of households with savings accounts in banks declines in Q3 2021

The percentage of households with savings accounts in banks decreased to 17 percent in Q3 2021 from 19.4 percent in Q2 2021.

Consumers expect interest and unemployment rates to increase, but the peso to depreciate in Q3 2021; Inflation to remain within the target range of 2 to 4 percent

The Q3 2021 survey results showed that consumers anticipated that interest rates may increase in Q3 2021, Q4 2021, and the next 12 months. The peso is expected to depreciate in Q3 and Q4 2021, but may appreciate in the next 12 months. Moreover, they also anticipated that the unemployment rate may rise in Q3 2021, but may decline in Q4 2021 and next 12 months. Households anticipated that the rate of increase in commodity prices will remain within the government’s inflation target range of 2 to 4 percent for 2021—at 3.4 percent for the next 12 months.

The number of OFW households that utilizes their remittances for the purchase of food and other household needs increases in Q3 2021

In Q3 2021, 96.5 percent of the 318 OFW household respondents (from 96.2 percent in Q2 2021) indicated that remittance proceeds were used to purchase food and other household needs.

About 1 in every 5 households availed of a loan in the last 12 months

In Q3 2021, about 1 in every 5 households, or 22.6 percent, availed of a loan in the last 12 months, lower than the 25.3 percent recorded in Q2 2021. However, the respondents who found it difficult to apply for a loan cited the following concerns: (a) too many requirements, (b) long processing time, and (c) difficulty of finding willing lender.

About the Survey

The Q3 2021 CES was conducted during the period 1 – 14 July 2021.1 In Q3 2021 CES, 5,670 households were surveyed – 2,853 (50.3 percent) were from the NCR and 2,817 (49.7 percent) from the AONCR.

Of the said sample size, 5,560 households responded to the survey, equivalent to a response rate of 98.1 percent (from 97.9 percent in the Q2 2021 survey). Respondents consisted of 2,816 households in the NCR (with 98.7 percent response rate) and 2,744 households in the AONCR (with 97.4 percent response rate). The middle-income group comprised the largest percentage of respondents (39.6 percent), followed by the low-income group (35.8 percent) and the high-income group (24.6 percent). (BSP)

———————————–

1 Approval for the conduct of the Q3 2021 CES was issued on 10 January 2019 through PSA Approval No. BSP-1901.