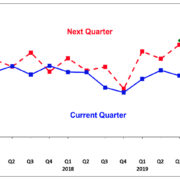

Sentiment of business owners improved for the second consecutive quarter. The overall confidence index (CI) for Q1 and Q2 both posted increases from previous quarter survey results, indicating greater optimism for many of the respondents. Specifically, CI for Q1 2021 increased to 17.4 percent from 10.6 percent in Q4 2020 while that for Q2 2021, rose to 42.8 percent from the previous quarter’s survey result of 37.4 percent. The respondents’ optimism for the two quarters was attributed primarily to the following: (a) easing of quarantine restrictions and reopening of businesses, (b) observations that people are adapting to the “new normal,” (c) increase in volume of sales and orders, (d) the rollout of vaccine for COVID-19, and (e) the development of new business/marketing strategies. Respondents also cited expectations of higher demand for electricity and construction activities during summer for their more buoyant views for Q2 2021.

Similarly, the business outlook on the country’s economy for the next 12 months was more upbeat as the CI increased to 60.5 percent from the Q4 2020 survey result of 57.7 percent predominantly due to the aforementioned reasons. Notably, the next 12 months CI is the highest index recorded since the start of the 12-month outlook in Q3 2019.

Trading firms remain optimistic for Q1 2021 and the near term

Favorable sentiment prevailed across the different types of trading firms (i.e., exporter, importer, dual-activity, and domestic-oriented), but at varying degrees. Importer, dual-activity, and domestic-oriented respondent firms were more confident on the business environment for Q1 2021, while exporters were less optimistic.

For Q2 2021, the different types of respondent trading firms indicated stronger optimism as the CIs for the said period registered higher levels than the Q4 2020 survey results, except for the domestic-oriented firms, whose outlook was broadly steady. Meanwhile, outlook of importer and dual-activity respondent firms was more favorable for the next 12 months. However, the outlook of the exporter and domestic-oriented respondent firms was less upbeat for the next 12 months.

Business sentiment generally improves across sectors for Q1 2021 and the near term

For Q1 and Q2 2021, the business sentiments of the industry and wholesale and retail trade sectors were more upbeat, while that of the construction sector was less optimistic. The outlook of the services sector was more buoyant for Q1 2021, but was broadly steady for Q2 2021.

Respondents expressed similar business sentiment for the next 12 months. Specifically, respondent firms in the industry and wholesale and retail trade sectors were more optimistic, while those from the construction sector were less favorable.

Firms’ outlook about their business operations is more buoyant for Q1 2021

Consistent with the national trend, the outlook of firms on their own business operations was more favorable for Q1 2021. Moreover, the sentiment of firms on the volume of business activity and total orders booked generally improved across sectors. For Q2 2021 and the next 12 months, the outlook on the volume of business activity was more upbeat across sectors, except for the construction sector, which was less optimistic.

Outlook on employment remains optimistic

The employment outlook index marginally increased but was significantly higher for the next 12 months, suggesting that firms are looking forward to hiring more people in Q2 2021 and the next 12 months.

Capacity utilization rises for Q1 2021, and expansion plans strengthen for Q2 2021

The average capacity utilization in the industry and construction sectors for Q1 2021 increased to 70.1 percent (from 67.9 percent in Q4 2020). Based on Q1 2021 survey results, the percentage of businesses with expansion plans in the industry sector rose for Q2 2021 but lower for the next 12 months.

Firms expect financial conditions and access to credit to remain tight for Q1 2021

The financial conditions index improved albeit remaining in the negative territory at -32.9 percent for Q1 2021 from -43.4 percent in the previous quarter. Further, firms indicated that their access to credit in Q1 2021 was still constrained as the credit access index remained negative at -7.5 percent for Q1 2021, although improving from -12.2 percent in Q4 2020. The negative index means that respondents who reported difficulties in accessing credit continued to outnumber those that said otherwise.

Firms expect a stronger peso and lower peso borrowing rate, but higher inflation for Q1 2021

The survey results showed that businesses expect the peso to appreciate against the U.S. dollar, peso borrowing rates to decline, but inflation to increase for Q1 2021. Firms anticipated the peso to depreciate for the next quarter and the next 12 months. Moreover, respondents indicated that inflation and peso borrowing rates were likely to increase for the next quarter and the next 12 months. Businesses expected that inflation rate will generally remain within the government’s 2-4 percent inflation target range for 2021 and 2022.

About the Survey

The Q1 2021 BES was conducted during the period 4 February–12 March 2021.1 There were 1,512 firms surveyed nationwide. Samples were drawn from the Top 7,000 Corporations ranked based on total assets in 2016 from the Bureau van Dijk (BvD) database, consisting of 585 companies in NCR and 927 firms in AONCR, covering all 16 regions nationwide. The nationwide survey response rate for this quarter was lower at 63.8 percent (from 64.8 percent in the Q4 2020). The response rate was lower for NCR at 61 percent (from 65.3 percent) but higher for AONCR at 65.6 percent (from 64.5 percent).

—————————————————————————————————————————————-

1 Approval for the conduct of the Q1 2021 BES was issued on 1 July 2019 through PSA Approval Nos. BSP-1939-01 to 04, which refers to the 4 questionnaire types of the BES.

—

Stay updated with news and information from the Bangko Sentral ng Pilipinas by visiting their website at https://www.bsp.gov.ph.